PSR publishes decision paper and further consultation on regulatory fees for 2018/19

Published on 6th June 2018

On 28 March 2018, the PSR and FCA published a combined consultation and decision paper on PSR regulatory fees for 2018/19 (CP18/8). The decisions, which will take effect from 2018/19, change the way in which PSR fees will be calculated. They also implement further changes to enable the FCA to calculate, bill and collect fees from PSR fee payers (including PSPs) directly, rather than relying on payment system operators to collect PSR fees on the FCA's behalf.

The consultation and decision paper sets out the decisions on the questions the PSR asked in CP17/44 relating to:

- the fees allocation method, including the proposal to allocate PSR fees based on fee payers’ transaction volumes and values; and

- the fees collection method, in particular the provision of transaction data by operators, the verification of transaction data and the provision of contact details and the payment dates.

How have fees been calculated in the past?

Historically, as set out in Annex 2 to CP17/44, fees have been allocated to two pots according to the jurisdiction under which the PSR exercises its powers: the Financial Services (Banking Reform) Act 2013 (FSBRA) and the EU Interchange Fee Regulation. For the 2017/2018 financial year, the allocation to the FSBRA pot was 95% of the annual funding requirement (the total PSR budget for the year).

Within each pot, the allocated amount of fees were split more or less equally across the payment systems within that pot. In the case of the FSBRA pot, this meant that annual funding requirement was divided equally between seven payment systems, including: BACS, C&CC and NICC, CHAPs, and Faster Payments. Within each system, payment service providers (PSPs) were then allocated a share according to the proportion of the total transaction volume within each system for which they accounted. PSPs that participated in more than one system were required to add up their fee obligations under each system to derive a total fee obligation.

The end result of all this was that participants in systems that processed a larger volume of transactions paid less per transaction than participants in systems that processed a smaller volume of transactions. Furthermore, at the PSP level, the use of transaction volume as the sole metric resulted in participants whose focus is on high-value low-volume business paying less than those who did high-volume low-value business, relative to the economic benefits derived. Further, the system appeared unnecessarily complex and increasingly unsuitable in the light of industry developments such as the consolidation of payment systems operators under the New Payment System Operator.

The new fee calculation methodology – with effect from 2018/19

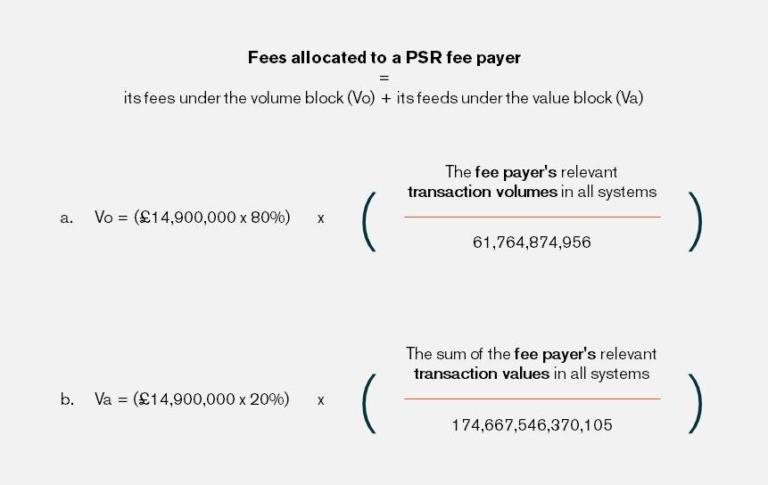

The new fee calculation methodology seeks to address all of the above deficiencies by splitting the AFR into two blocks, a volume block and a value block, in the ratio 80:20. Each PSP's fee contribution is then calculated in proportion to the number of transactions it conducts, whilst also taking into account the proportion of total transaction value that the PSP accounts for.

By calculating a part of the fee in relation to the value of transactions, this addresses the perceived inequality between the fees paid by high-value low-volume businesses and those paid by high-volume low-value businesses. Similarly, by removing the equal split across the seven (historical) payments systems operators, an arbitrary insensitivity to the relative size of each payment system is eliminated. By rationalising the calculation, simplicity, longevity and flexibility is enhanced.

Each payer’s PSR fees for 2018/19 is determined by the following formula:

Further consultation issues about fees and refund

As well as changing the formula for fee allocation, the PSR makes further proposals on its fees allocation method relating to: (i) its approach to publishing annual fees figures in future; (ii) updated definition of relevant transactions for fees allocation; (iii) its approach to on-account fees collection from 2019/20 onwards; and (iv) refund of underspend, including the 2017/18 underspend.

The FCA expect to issue a policy statement in summer 2018.

Amendments to FEES 9 rules in the FCA Handbook

Separately, the FCA has published the Fees (Payment Systems Regulator) Instrument (No 6) 2018 (FCA 2018/9), made by the FCA Board on 22 March. The instrument came into force on 1 April 2018 and makes amendments to FEES 9 and the Glossary in the FCA Handbook.

The FCA will calculate, bill and collect PSR fees from PSR fee payers directly, and the operators of payment systems will no longer be required to bill and collect fees from PSR fee payers.