Information note for small public offerings or the admission to trading on an MTF

Published on 15th October 2018

Today (15 October 2018), the Royal Decree of 23 September 2018 on the publication of an information note for a public offering or admission to trading on an MTF and various financial provisions entered into force.

The Royal Decree transposes several provisions of the new Prospectus Regulation (Regulation (EU) 2017/1129) and follows on from the law of 11 July 2018 (the Law) which regulates specific national measures in the framework of the Prospectus Regulation and which replaces the law of 16 June 2006 on the public offering and admission of securities to trading on a regulated market.

Information note or mandatory prospectus?

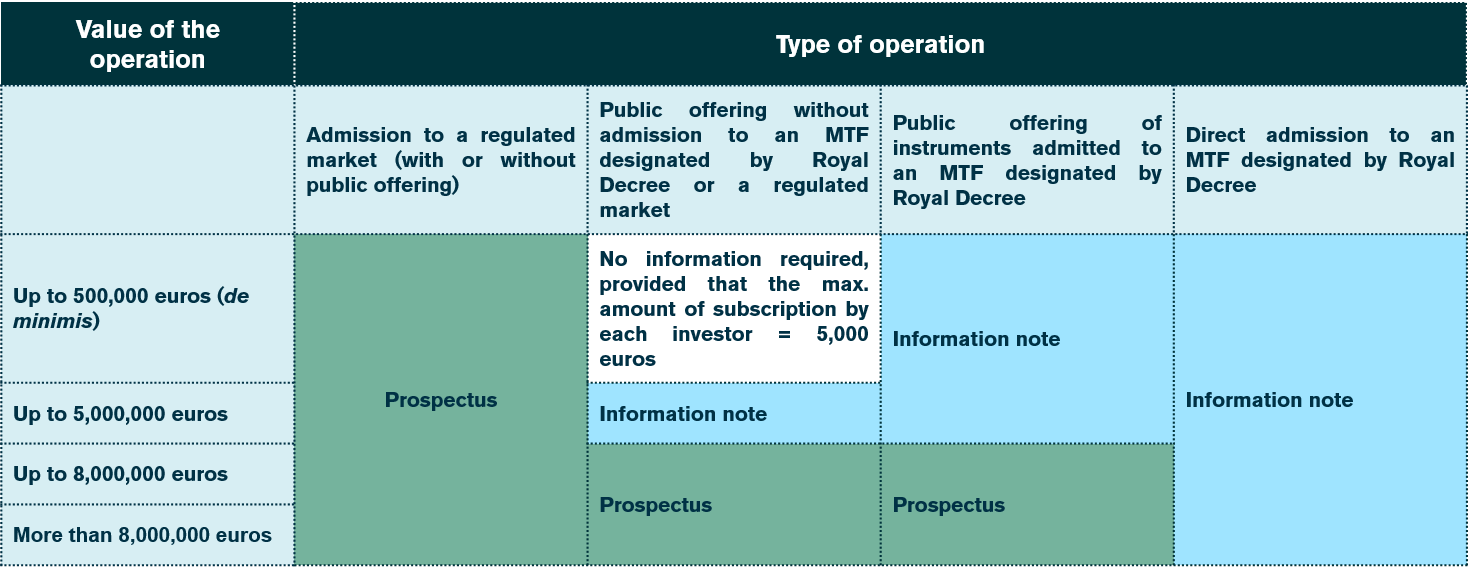

The Royal Decree implements amongst others the application of a mandatory prospectus or information note.

An information note is much shorter than a prospectus and does not require prior review or approval by the FSMA. The Law requires the preparation of an information note - and therefore removes the prospectus requirement - in the following events:

- public offerings (without admission to trading) for an amount of not more than EUR 5 million over a 12-month period;

- public offerings for an amount of not more than EUR 8 million over a 12-month period, provided that the securities are (to be) admitted to trading on an MTF designated by Royal Decree; or

- the admission of securities to trading on certain MTFs or MTF segments designated by Royal Decree, regardless of the amount of the transaction (except for certain specific admissions of new securities up to 20% of the existing securities listed on an MTF or securities with a nominal value per security of at least EUR 100,000).

No prospectus or information note is required for public offerings for an amount of less than EUR 500,000, provided that investors cannot subscribe to the public offering for more than EUR 5,000 (de minimis regime). This de minimis regime therefore raises the existing exemption threshold for crowdfunding campaigns previously set at EUR 300,000 (see also our newsflash of 6 January 2017).

The table below summarizes the above requirements:

The content and structure of the information note determined by the Royal Decree is as follows:

- public offerings (see requirements in French and Dutch); and

- the admission to trading on an MTF or MTF segment (see requirements in French and Dutch).

The Royal Decree also confirms that Alternext (trading under the name Euronext Growth) and the Vrije Markt/Marché Libre (trading under the name Euronext Access) qualify as MTF's within the framework of the Prospectus Regulation and the Law.

What to expect / do now

Although the majority of the changes introduced by the Law and the Prospectus Regulation are due to become fully effective from 21 July 2019, the new thresholds for the application of a mandatory prospectus or information note, including the exemptions thereto, have been effective since 21 July 2018.

As of today (15 October 2018), companies that would like to proceed with a new public offering or an admission to an MTF within the limits of the abovementioned thresholds must ensure that they adhere to the new requirements governing information note content and structure. We expect that the new rules will accelerate and facilitate public offerings of less than EUR 5 million and listings of less than EUR 8 million on Euronext Growth or Euronext Access.

Current public offerings can continue their offering under the old regime. However, on-going offerings benefiting from the exemption previously available to (i) cooperative companies raising funds of less than EUR 5 million and (ii) securities offered to employees pursuant to participation plans must convert their offer document into an information note before 21 October 2018 (except if they fall under the de minimis regime).

To discuss this, please contact one of our experts listed below.