Impact investing - Fundraising for good or good for fundraising?

Published on 14th October 2019

Earlier this month, we hosted a thought-provoking debate on Impact Investing – Fundraising for Good or Good for Fundraising? Keynote speaker Maggie Loo (Bridges Fund Management Limited) and our expert panellists including Hugo Llewelyn (Newcore Capital Management LLP), Jane Bowes (Threadmark), Cameron McLain (Giant Ventures) and Karen Ng (Big Society Capital) shared their thoughts on this hot topic. We have summarised the main points in our note below.

Background

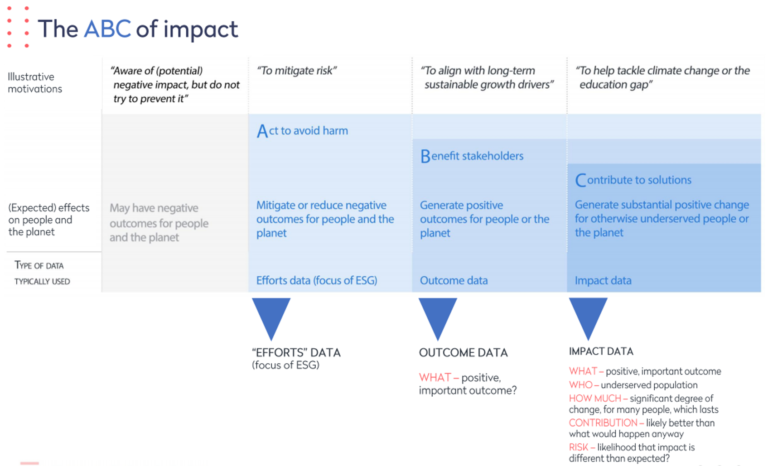

The "ABC" of Impact

The UN Sustainable Development Goals - a universally adopted framework specifically designed to assess socioeconomic impact - are a cornerstone to Bridges' impact strategy. By applying this framework to the capital markets, the Bridges team has developed the "ABC of Impact", presenting the impact economy as a spectrum – can this methodology be a game changer?

- The impact economy is a spectrum. In the same way that risk is managed through a portfolio approach, all areas of the impact economy can be reached by packaging investments with a varying degree of impact into one fund. The entirety of the ABC spectrum should be utilised when considering a portfolio approach to impact.

- Impact Management and Data. "Measuring" impact against set targets ensures capital is deployed into credible schemes. Without this information, investors will struggle to differentiate the impact economy from carefully crafted ESG policies.

- Impact and profit are not mutually exclusive. Bridges impressive track record of delivering strong returns through investments in the impact economy proves that the two can go hand-in-hand.

Source: The Impact Management Project

Key Takeaways from the panel discussion that followed:

- The next generation is demanding more from businesses

- Although profit remains at the core of all investment activities, there is a growing consensus that profitable investments must be aligned with a beneficial socioeconomic impact.

- There is growing recognition from business leaders and senior managers that businesses need to do more.

- There is still a fundamental need for philanthropists and third sector organisations in the areas that cannot be reached through impact investment.The next generation is demanding more from businesses

- Changing the mindset from within: it starts at the top

- Hugo Llewelyn of Newcore Capital Management LLP emphasised "moral businesses require moral employees". Without a conscious effort from top level management to embed this ideology into the culture of the business, any attempt to invest in the impact economy could be seen as arbitrary.

- Cameron McLain of Giant Ventures emphasised this point, adding that values should be "codified" to ensure businesses are aligned in their approach to impact investing.

- For smaller equity houses, this process starts with the founder. If the founder is willing to challenge the status quo and stand accountable for socioeconomic impact and financial returns, those that join will help to deliver these returns and spread the message across the marketplace.

- Global markets require simplified language

- We need to be clearer about what we mean by "impact investing".

- Language must be simple and universal to ensure all stakeholders – from investors to impact managers, understand the goals underpinning impact/purpose driven investment.

- Frameworks and data capture – the key to impact assessment

- Recording the impact of investments is becoming a key element of the impact economy: a call from investors is being answered by those fund managers that actively gather impact-related data.

- Fund of funds must work especially hard to collect this information from further down the investment chain.

- Without accountability, the impact economy could be exploited

- Investors are increasingly aware of the influence of capital in the impact economy. As such, managers must be held accountable when promoting products that promise to deliver social, environmental, and capital returns.

- Accountability can be driven through target setting and clear objectives from the outset.