Dutch government proposes bill to provide more clarity on workers' status

Published on 13th October 2023

The bill is part of broad labour market reforms for greater security for workers and more agility for entrepreneurs

The Dutch government has proposed a bill to clarify and improve the legal framework for determining the status of employees and self-employed persons in the labour market. The bill aims to address the problem of false self-employment, which affects the rights and protections of workers, the fair competition among businesses, and the (financial) contribution to the social security and welfare system.

The bill consists of two main measures. There is a clarification of the concept of performing labour under the authority of the employer, which is the distinctive criterion for the qualification of an employment agreement. And it also introduces a rebuttable presumption of an employment agreement based on an hourly rate.

Authority criterion

The clarification of the concept of performing labour under the "authority" of the employer involves structuring and specifying the elements that indicate the existence or absence of an authority relationship between the worker and the work supplier.

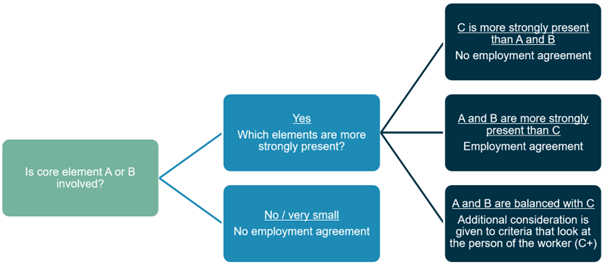

The bill proposes to amend article 7:610 of the Dutch Civil Code by adding three main elements (see chart below): work-related instructions (A), organisational embedding (B), and – as a counter-indication for working in service of an employer – working for one's own account and risk (C).

If indicator (A) or (B) is present to a similar extent (equally relevant) as indicator (C), an additional element is whether the worker generally behaves as an entrepreneur or an employee in the economy with regard to similar work (C+).

Schematically, this is illustrated in the bill as follows:

The bill aims to create a clear, simple and contemporary framework for assessing work relationships, based on the existing case law and literature, and to reduce the grey area and the possibilities for circumvention of the law.

Rebuttable presumption based on hourly rate

The rebuttable presumption of an employment agreement based on an hourly rate is a new instrument that aims to provide more legal certainty and protection for low-paid workers who are false self-employed persons.

The bill proposes to introduce article 7:610aa in the Dutch Civil Code, which states that if a person performs work for an hourly rate lower than a certain threshold, there is a presumption that an employment agreement exists, unless rebutted. The threshold for the hourly rate stipulated in the bill (reference date 1 July 2023) is €32,24 per hour. The threshold is linked to the statutory minimum wage, so it will increase if the minimum wage is increased (which is typically twice a year).

The bill aims to create a simple and objective criterion for distinguishing between workers and self-employed persons at the lower end of the income spectrum, and to facilitate the enforcement of labour rights and obligations.

Labour market reform

The bill is part of a broader package of measures to reform the Dutch labour market, following the recommendations of the Commission on the Regulation of Work (Commissie Regulering van Werk). In a nutshell, the commission presented proposals for a labour market package with coherent measures for greater security for workers and more agility for entrepreneurs. The aim is that the bill will enter into force on 1 July 2025.

What happens next?

The bill and explanatory memorandum have now been published for internet consultation. The internet consultation allows citizens, businesses and civil society organisations to submit comments and ideas on the bill. Until 10 November 2023, comments can be submitted via the Dutch government's website.

Our experts can tell you more about what this bill will mean for your organisation.