How to calculate degrees of kinship for the reduction in Spanish Inheritance and Gift Tax to transfers of family businesses

Published on 20th May 2019

In the context of the Inheritance and Gift Tax reduction for transfers of family businesses (Ruling from the Spanish Central Economic-Administrative Court dated 16 October 2018), the Spanish Central Economic-Administrative Court does not follow the criteria set by the General Directorate for Taxes on how to assess the degree of kinship in those cases where the holding in the family business is calculated together with other family members.

Under the Spanish Inheritance and Gift Tax Act ("IGTA"), the application of the tax reduction to transfers of family businesses (holdings in entities) requires that such holdings comply with the exemption provided for under paragraph 8 of article 4 of Act 19/1991, dated 6 June, on Wealth Tax.

One of the requirements imposed for Wealth Tax purposes is that the holding in the entity considered should amount to at least 20%. Such holding stake is calculated together with the holdings of relatives up to the second degree of kinship. Additionally, one of the individuals within this kinship perimeter must receive compensation for undertaking a management role in the entity.

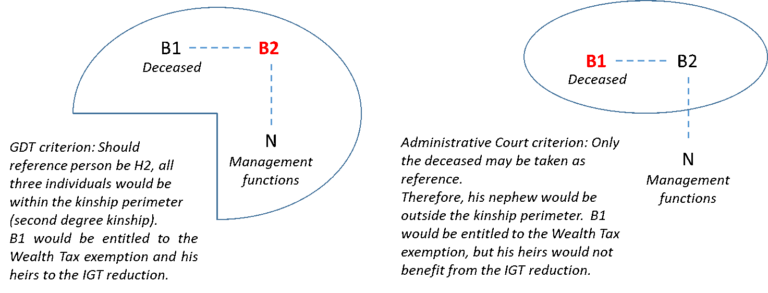

The General Directorate for Taxes ("GDT"), in several rulings (for instance V0213-12 and V2737-11), takes the view that the degree of kinship may be assessed by reference to any individual within the group considered. Therefore, for example, in the case of two brothers, where one has no descendants and the other has one child, who is the only family member who receives compensation for management functions, the father may be taken as the reference person. In this case, the father would be in the first degree of kinship with regard to his son and in the second degree with regard to his brother. All the family members would comply with the Wealth Tax exemption and would be entitled to the Inheritance and Gift Tax ("IGT") reduction for the family business transfer in the inheritance. The GDT considers that the Wealth Tax exemption is directly linked to the IGT reduction and that the reference, which the IGTA makes to the Wealth Tax is a complete reference; i.e. both to the text and to the interpretation criteria applied to such text.

However, the Spanish Central Economic-Administrative Court, in its ruling dated 16 October 2018 (and other rulings with the same criteria, such as 18 January 2018 and 23 February 2012) does not follow the GDT's view and states that: "for the purposes of inheritance taxation, the individual who should be taken as reference for the kinship group is fixed and can be no other than the deceased." With regard to the IGT reference to Wealth Tax, the Court adds "such reference is inevitable in an analysis of whether the reduction applies or not. However, it cannot mean that, aside from the objective considerations highlighted before, all the interpretation criteria applied in the context of Wealth Tax, to determine whether an exemption from such tax applies, must necessarily be binding for the purposes of inheritance taxation".

Therefore, following the example above and following the GDT's view, both brothers would be entitled to the Wealth Tax exemption. Moreover, should one of them pass away, the heirs to either would be entitled to the Inheritance tax reduction. By contrast, the Court maintains that, should the brother without descendants pass away, his heirs would not be entitled to the tax reduction in the transfer of the family business. Indeed, kinship calculated with reference to the deceased would lead to the conclusion that the person carrying out management functions in the family business, the nephew, has a third degree kinship with the deceased. Such person would therefore fall outside the legally required second degree perimeter and therefore the requirements for the IGT reduction would not have been complied with:

Should the view currently favoured by the Spanish Central Economic-Administrative Court prevail (the courts still have to rule on this matter), this would affect mainly businesses where the third generation has a stake in the capital or takes part in the management. It would therefore be appropriate to review whether these cases fulfil the conditions for the IGT reduction. For these purposes, it would be necessary to analyse not only national provisions but also provisions from the corresponding Autonomous Regions. In this regard, certain Autonomous Regions have already extended the kinship perimeter, such as Aragon where reference is made to the fourth degree of kinship, or Catalonia with the third degree of kinship.

Moreover, the Central Economic-Administrative Court's position makes it possible to question other aspects of the Wealth Tax reference for IGT purposes. Therefore, the Tax Authorities of each Autonomous Region may reinterpret IGT provisions, leading to situations of legal uncertainty which would again need the intervention of the Courts.