Consumer payment accounts must comply with new transparency requirements from 31 October 2018

Published on 2nd May 2018

On 30 April 2018, the FCA published the UK's final linked services list. This is a list of standardised terminology which describes the most representative services linked to certain types of payment accounts.

Under the Payment Accounts Regulations 2015 (PARs), certain transparency requirements (set out in Part 2 of the PARs) come into force 6 months after publication of the final linked services list.

This means that if you are a firm offering a 'payment account' as defined in the PARs, you now have until 31 October to implement the following changes:

- amend your terms and conditions and marketing information if necessary to use the standardised terms set out in the linked services list (for example "arranged overdraft" and "unarranged overdraft", "refusing a payment due to lack of funds" and "cancelling a cheque");

- make available to consumers a glossary of the terms set out in the linked services list and the related definitions on your website and over the counter in a durable medium;

- provide consumers with a fee information document (FID) pre-contract in a durable medium. The FID must comply with strict form and content requirements which are available here; and

- provide consumers with an annual statement of fees.

Under the PARs, the FCA is required to monitor compliance with these transparency requirements and will have the power to publically censure and penalise firms which fail to comply.

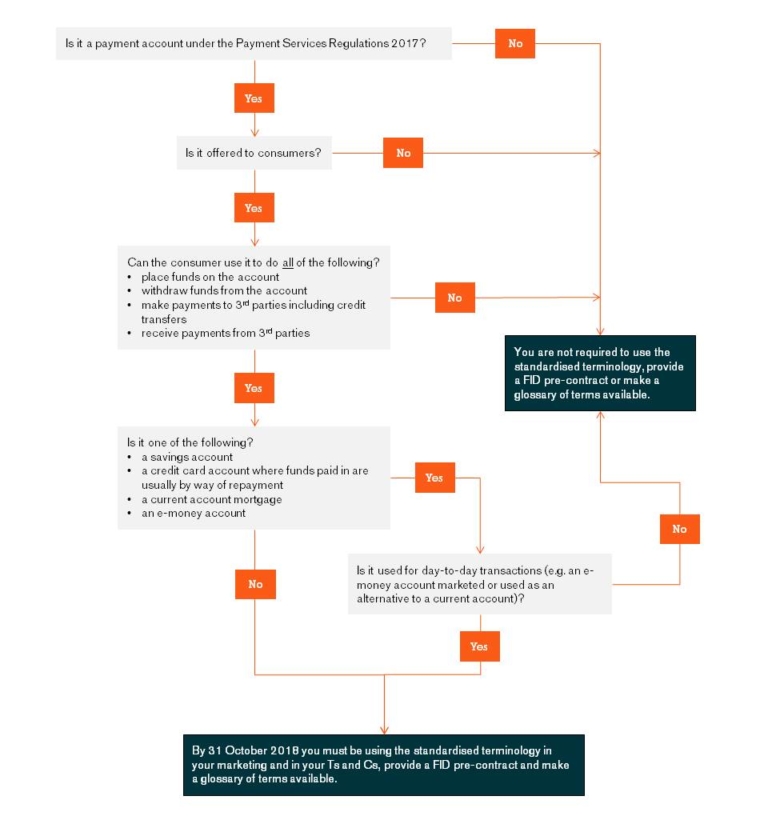

To check if any account you offer are caught by the new requirements, use our decision tree below: