Challenges of the new German wage tax deferral for German start-ups in an international setting

Published on 13th Sep 2021

The new German wage tax deferral (of up to 12 years) applicable to start-up equity awards simplifies - in many cases - the tax structuring of the underlying equity plan. But in an international setting, ambiguous wording makes the tax deferral position unclear

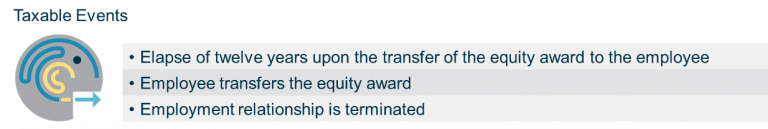

In principle, as in many jurisdictions, granting an equity award by a German employer to an employee might result in employment income that triggers German wage tax, even though no cash has been received (dry income). Under the new law, an employee of a start-up can avoid such taxation, if he opts for a delayed payment of these taxes. This wage tax deferral applies as long as none of the following taxable events occur:

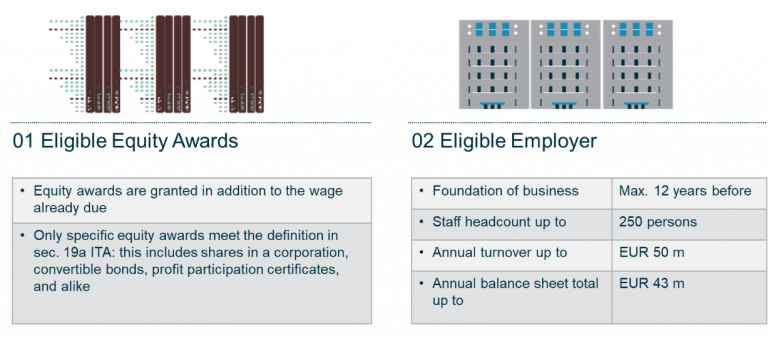

The employee can only exercise the option if both the equity awards granted and the employer meet the requirements summarised below:

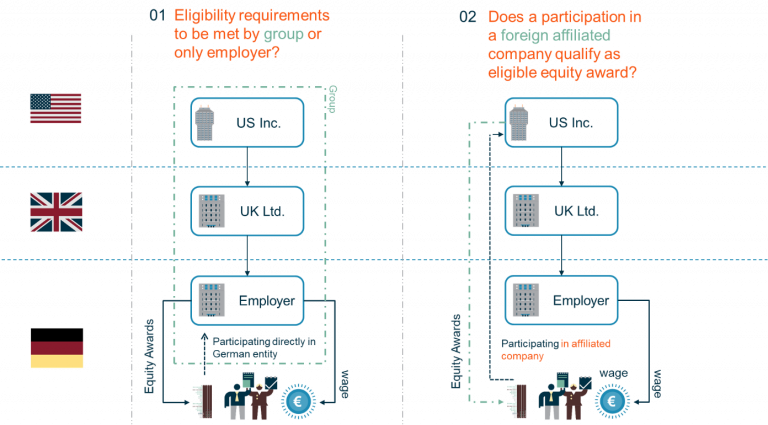

While these prerequisites should be applicable in a straightforward manner to stand-alone start-ups, there is less legal certainty in the case of start-ups that are embedded in a corporate group. This is especially the case if the involved group entities are located in different jurisdictions.

These difficulties result from the fact that there is no clear definition of the term “enterprise of the employer” that the law refers to in applying the eligibility test. This definition is critical when deciding which equity awards and employers are eligible. The term could refer, for example, to any entity of the entire group or to the employing entity only. These uncertainties raise the following questions:

As the new law has only applied since 1 July 2021, the position is untested and it is not clear how it will be applied by the German tax authorities and the fiscal courts. In the examples above, the risks are high that the German tax authorities would reject a wage tax deferral due to a different understanding of the ambiguous definition of the “enterprise of the employer”. If that happens and the wage tax deferral has already been applied, the employer becomes retrospectively liable for the wage tax.

Osborne Clarke comment

Although the wage tax deferral simplifies the tax structuring of equity plans and can avoid to a certain extent the taxation of dry income, its application is not reliable in an international setting. Therefore, other structuring approaches to delay such taxation remain relevant (for instance using options and vesting systems, or restricted stock units). However, these approaches are also targeted by the German tax authorities, so an employer might still face the risk of a retrospective wage tax liability.

We therefore recommend that:

- equity plans involving German employees should be examined with a view to the question of whether the intended wage tax deferral is feasible under German tax law; and

- any issues resulting from the ambiguity of the law should be addressed early in an application for a binding wage tax ruling.