Are payment service providers going to become VAT collectors? HMRC consultation on VAT "split payments"

Published on 6th June 2018

Building on the 2017 call for evidence, HMRC has launched a formal consultation into implementing a VAT "split payments" system. If adopted, this could effectively make PSPs (both card issuers and merchant acquirers) collectors of merchants' VAT liabilities. This may require significant changes to PSPs' (and potentially card schemes’) technology systems and contractual arrangements.

Why is HMRC looking at introducing a split payments system?

As a reminder of how VAT works, if a customer buys a widget for £120 and VAT has been applied at the standard rate of 20%, this means that £20 of that amount is VAT and £100 is the VAT-exclusive price. While the customer is contractually required to pay the merchant the full £120, it is the merchant who is required by the UK tax rules to account for the VAT to HMRC.

HMRC is concerned that online merchants based outside the UK are not complying with their VAT obligations correctly. In the Revenue's view, this is costing the UK exchequer substantial amounts in lost tax revenue.

The current consultation: what is being proposed

In March 2017, HMRC published a call for evidence for a "split payments" method for collecting VAT. This was followed up by a consultation published in March 2018, with responses due by 29 June 2018.

Essentially, the proposals require payment service providers (PSPs) to deduct an amount in respect of VAT from the total payment given by the customer, account for the VAT to HMRC, and then pay the balance to the merchant. In this way, PSPs (both card issuers and merchant acquirers) would effectively be made VAT collectors.

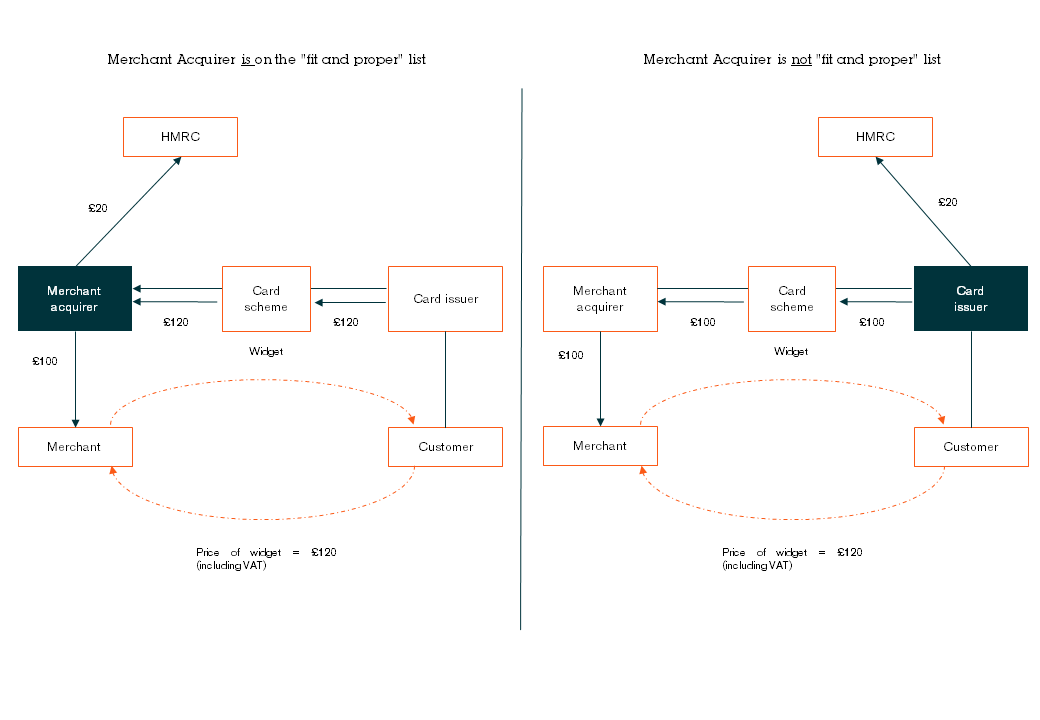

The consultation proposes that certain types of PSP should be responsible for making the deductions. HMRC is proposing to set up a list of "fit and proper" merchant acquirers, and whether or not a merchant acquirer appears on that list determines which party has to split the payment. There are two scenarios:

- The merchant acquirer is on the "fit and proper" list. In that case, the issuer would remit the full payment to the merchant acquirer through the relevant card scheme. The merchant acquirer would then be required to split the payment, pay the VAT element to HMRC and remit the balance to the merchant.

- The merchant acquirer is not on the "fit and proper" list, in which case the card issuer would have to split the payment, pay the VAT element to HMRC and remit the balance to the merchant acquirer, through the relevant card scheme, who would in turn remit that amount to the merchant.

Looking at the widget example above, if the payment were made electronically, this would mean that the PSP (being the merchant acquirer, if it is on the “fit and proper list”, or otherwise the card issuer) would deduct £20 from the £120 paid by the customer, pay the £20 to HMRC, and then pay the £100 balance to the merchant. In other words, the £120 is "split" between the VAT and the VAT-exclusive consideration.

The consultation focuses on sales of goods by overseas retailers to UK consumers. However, HMRC has not decided on the exact scope of the system, so it is possible that it could also apply to UK retailers, sales of services and business-to-business sales. The system could also apply to other payment intermediaries, such as payment initiation service providers (PISPs).

One of the questions HMRC is consulting on is how long PSPs (and, potentially, card schemes) would require to implement the split payment system, so there is not yet any clarity on timescales.

What does this mean for PSPs?

The split payment system would be complex and may require costly changes to technology systems. It is also likely that PSPs would seek to pass on at least part of these costs to merchants, necessitating a review of existing contractual fee arrangements.

Merchant acquirers would also have to consider whether or not to apply to join HMRC's "fit and proper" list. HMRC has not yet specified what this will involve. It is also not clear why a merchant acquirer would choose to join the "fit and proper" list if doing so makes it (as opposed to the issuer) responsible for splitting the payment. It may therefore be that issuers make it a contractual requirement to join the "fit and proper" list as a pre-condition for transacting, through the relevant card scheme, with the merchant acquirer.

In addition, some merchants may sell zero-rated (e.g. food) or reduced-rated (e.g. children's car seats) goods. This means that no, or a reduced amount of VAT, should be collected by the merchant acquirer or issuer. The question is, how do you build enough flexibility into the system to collect the right amount? The consultation suggests various options, each of which have their own draw-backs:

- Simply assume all sales are standard rated, and collect VAT on that basis. This would make the system simpler for the PSPs, but would mean that the merchant will need to "true up" the correct amount of VAT in its own VAT returns.

- Use a "flat rate" scheme, whereby the amount collected depends on what type of industry the merchant operates in. This would add more complexity for the PSPs, and still wouldn't result in entirely the correct amount of VAT being collected.

- Use a "net effective rate" scheme, which gives a bespoke amount to be collected for each merchant this year, based on its actual fraction last year. This would likely be very complex for PSPs to implement.

Another question to be addressed is what if a PSP makes an error in splitting the payments – would it be the PSP that is liable for that, or the merchant? The consultation suggests that the system should be designed so that ultimate liability for accounting for VAT rests with the merchant. However, HMRC will need to confirm this point and PSPs should then review their contractual arrangements accordingly.

Finally, where there is a customer refund, HMRC suggests that the PSP would need to be responsible for reversing part of the VAT amount collected. This would add another layer of complexity to the system.

Interestingly, the government anticipates that compliance by the relevant PSP could be enforced by the card schemes, through their power to revoke a merchant acquirer’s operational licence in the event of non-compliance with regulatory requirements. Bearing in mind that responsibility for making the deductions can switch between the merchant acquirer and the card issuer depending on whether the former appears on the “fit and proper” list, it is unlikely that card schemes will have much of an appetite to act as HMRC’s enforcer in this way.

Comment

These are clearly proposals to keep a close eye on, as they could have a significant impact on PSPs’ (and potentially card schemes’) operating costs, technology requirements and contracts.

HMRC has held one-to-one meetings with a number of stakeholders, including banks, technology companies, and representative bodies of the payments industry, to discuss these proposals in more detail. HMRC will also be running a series of collaborative workshops to test emerging views over the summer and invites all those with an interest to get in contact to make arrangements to attend.

Those wishing to contribute and provide comments in response to the consultation are requested to do so by 29 June 2018.